The Ultimate Guide To Medicare Advantage Agent

Voters and policy makers in emphasis team conversations define those without insurance as young individuals that have the chance to be covered and feel they do not require it (Concierge Novelli, 2001). Contrasted to those with at least some exclusive coverage, the uninsured are less likely to report being in outstanding or great health(Company for Healthcare Study and Top Quality, 2001). RESOURCE: Center for Expense and Financing Studies, Firm for Medical Care Research Study and Top quality, based upon MEPS data. Young person between 19 and 34 are much more most likely to lack medical insurance than any kind of various other age team. This is chiefly because they are much less usually qualified for employment-based insurance policy as a result of the nature of their task or their short tenure in it. The understanding that people without insurance policy have better-than-average health

follows from perplexing the reasonably young age account of the uninsured with the much better wellness, generally, of more youthful persons. This covers the web link between wellness condition and health insurance. For those without access to work environment medical insurance, poor wellness is a prospective barrier to buying nongroup insurance coverage because such insurance coverage might be extremely valued, leave out preexisting problems, or be just unavailable. The variety of without insurance Americans is not particularly huge and has not transformed recently. 7 out of ten respondents in a nationally representative survey assumed that less Americans lacked health and wellness insurance policy than really do(Fronstin, 1998). Approximately half(47 percent )thought that the number of people without health insurance reduced or stayed continuous over the latter half of the last years(Blendon et al., 1999). This decline of practically 2 million in the variety of individuals 'without insurance coverage (a reduction

of around 4 percent)is certainly a positive change. With a softer economic climate in 2000 the most up to date reported gains in insurance policy coverage might not proceed(Fronstin, 2001 ). The decline in the number of uninsured will certainly not continue if the economy remains slow and healthcare prices remain to outpace rising cost of living. This is because the information were gathered for a period of solid financial performance. Of the approximated 42 million people who were uninsured, almost about 420,000(concerning 1 percent)were under 65 years of age, the age at which most Americans come to be qualified for Medicare; 32 million were grownups in between ages 18 and 65, around 19 percent of all grownups in this age team; and 10 million were children under 18 years old, regarding 13.9 percent of all youngsters (Mills, 2000). These estimates of the number of individuals uninsured are produced from the annual March Supplement to the Existing Populace Study (CPS), conducted by the Census Bureau. Unless or else kept in mind, national estimates of individuals without wellness insurance coverage and proportions of the population with different kinds of coverage are based on the CPS, the most extensively made use of source of estimates of insurance protection and uninsurance rates. These surveys and the price quotes they generate are described briefly in Table B. 1 in Appendix B - Medicare Advantage Agent. These studies vary in size and tasting approaches, the questions that are asked concerning insurance

The 20-Second Trick For Medicare Advantage Agent

protection, and the time duration over which insurance coverage or uninsurance is measured(Lewis et al., 1998, Fronstin, 2000a ). Still, the CPS is particularly beneficial due to the fact that it generates annual price quotes reasonably swiftly, reporting the previous year's insurance protection approximates each September, and due to the fact that it is the basis for a regular collection of estimates for even more than twenty years, enabling for analysis of patterns in insurance coverage with time.

Unknown Facts About Medicare Advantage Agent

Over a three-year period starting early in 1993, 72 million people, 29 percent of the united state population, were without insurance coverage for a minimum of one month. Within a solitary year(1994), 53 million people experienced a minimum of a month without coverage(Bennefield, 1998a). Six out of every ten uninsured adults are themselves utilized. Although working does boost the likelihood that a person and one's household participants will have insurance policy, it is not a warranty. Even members of family members with 2 full time wage income earners have practically a one-in-ten chance of being without insurance (9.1 percent without insurance rate)(Hoffman and Pohl, 2000 ). The connection in between health and wellness insurance and accessibility to care is well established, as recorded later on in this chapter. The relationship between health insurance policy and health outcomes is neither direct neither straightforward, an extensive scientific and health solutions research literature links health insurance protection

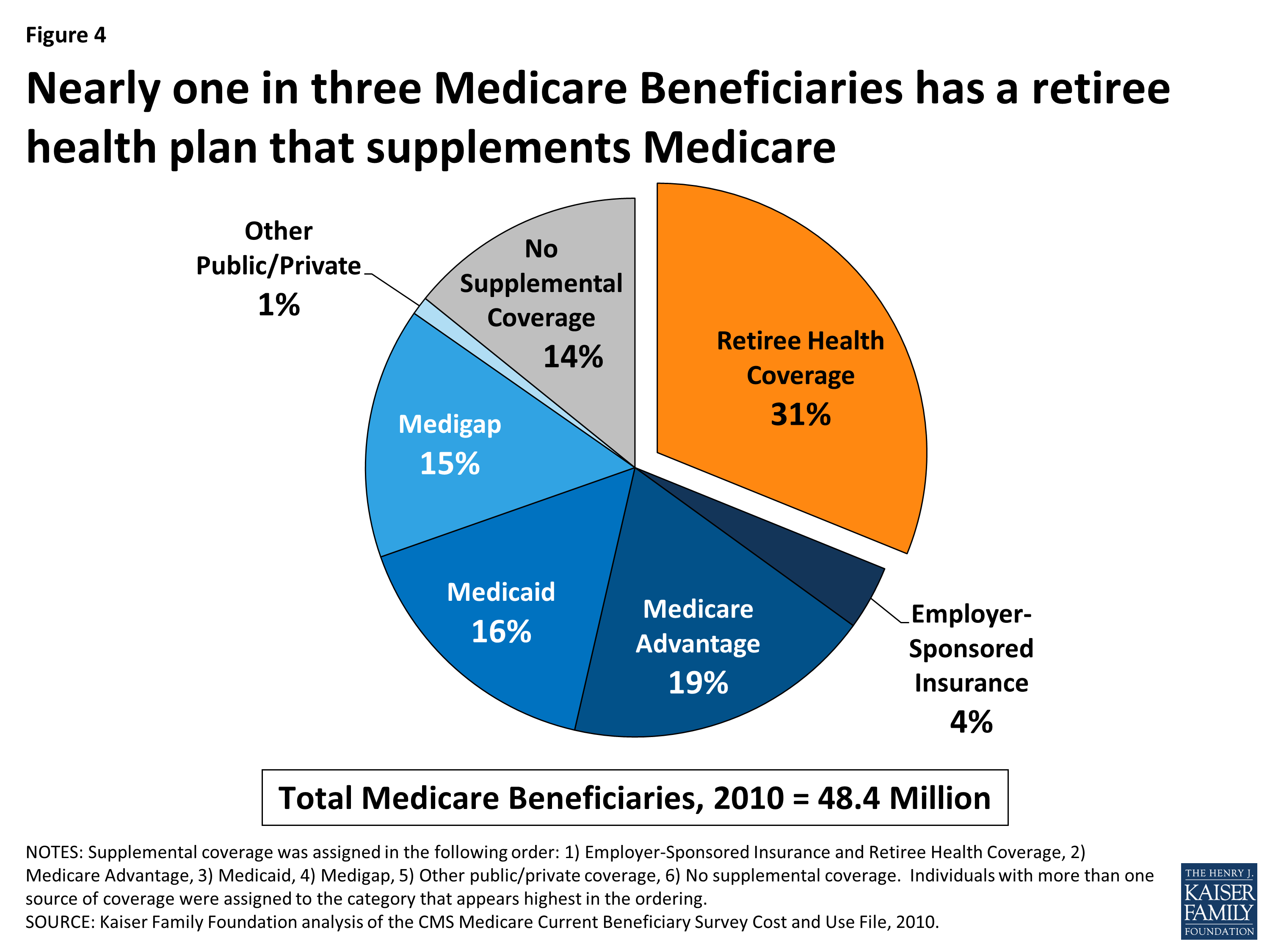

to improved access to care, better qualityHigh quality and improved enhanced and population populace health and wellnessCondition For instance, the second report, on personal wellness results for uninsured adults, is stood for by the inner circle of the number, while the third record, on family members wellness, encompasses the topics of the 2nd report however highlights a various unit of analysis, specifically, the family members. The 6th report in the series will provide details concerning techniques and campaigns undertaken locally, statewide, or country wide to deal with the lack of insurance coverage and its negative impacts. Degrees of analysis for analyzing the effects of uninsurance. This conversation of medical insurance coverage concentrates mostly on the U.S. populace under age 65 because basically all Americans 65 and older have Medicare or various other public protection.

It focuses specifically on those without any wellness insurance for any size of time. The problems faced by the underinsured are in some respects similar to those faced by the uninsured, although they are usually much less extreme. Uninsurance and underinsurance, however, entail noticeably different policy concerns, and the approaches for resolving them may vary. Throughout this study and the 5 records to follow, the primary focus is on persons without any health and wellness insurance policy and therefore no help in spending for healthcare beyond what is readily available via charity and safety and security web institutions. Medical insurance is an effective variable impacting receipt of treatment because both people and medical professionals respond to the out-of-pocket rate of services. Medical insurance, nonetheless, is neither required neither enough to access to clinical solutions. The independent and straight impact of health and wellness

insurance coverage on access accessibility health health and wellness is well established. visit their website Others will obtain the health and wellness care they require even without medical insurance, by paying for it expense or seeking it from providers that offer treatment complimentary or at highly subsidized rates. For still others, medical insurance alone does not ensure receipt of treatment as a result of various other nonfinancial barriers, such as a lack of healthcare providers in their community, restricted access to transport, illiteracy, or linguistic and cultural distinctions. Official research study about without insurance populaces in the USA dates to the late 1920s and very early 1930s when the Committee on the Cost of Medical Care produced a series of reports regarding funding physician workplace visits and hospitalizations. This concern ended up being significant as the varieties of clinically indigent climbed throughout the Great Depression. Empirical studies continually support the link between access to care and boosted health results(Bindman et al., 1995; Starfield, 1995 ). Having a routine source of check here treatment can be taken into consideration a predictor of accessibility, rather than a straight step of it, when wellness results are themselves used as access indicators. This expansion of the idea of access dimension was made by the IOM Board on Checking Access to Personal Healthcare Provider(Millman, 1993, p. Whether moms and dads are insured shows up to impact whether their children obtain care in addition to exactly how much careeven if the children themselves have insurance coverage(Hanson, 1998). The health of parents can influence their capability to look after their youngsters and the degree of household tension. Stressing over their youngsters's access to care is itself a source of stress and anxiety for moms and dads. 3 phases adhere to in this report. Chapter 2 supplies an introduction of exactly how employment-based medical insurance, public programs and specific insurance plan run and connect to give comprehensive yet insufficient coverage of the united state populace. This includes an evaluation of historical trends and public laws influencing both public and exclusive insurance coverage, a conversation of the communications among the various sorts of insurance policy, and an evaluation of why individuals relocate from one program to an additional or wind up